Toyota Tundra Depreciation

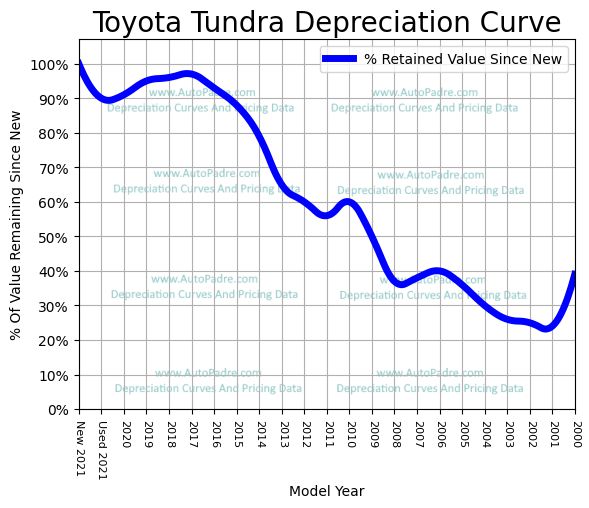

It loses just 359 percent of its value or about 12000 over the first five years of its life.

Toyota tundra depreciation. Business Use Tax Deduction on vehicles Section 179. ISeeCars recently analyzed over 7 million new and used vehicles to determine which were the best and worst at retaining value. Toyota Tacoma 324 10496 3.

2012 Limit on Capital Purchases 560000. Car Depreciation Comparison Charts for Toyota 4Runner vs Toyota Tundra vs Toyota Tacoma vs SUV The first chart below shows the percent deviation between the Industry Average the Toyota 4Runner the Toyota Tundra the Toyota Tacoma and SUV with years in age as the intervals. 2019 SR5 CM CEMENT GREY.

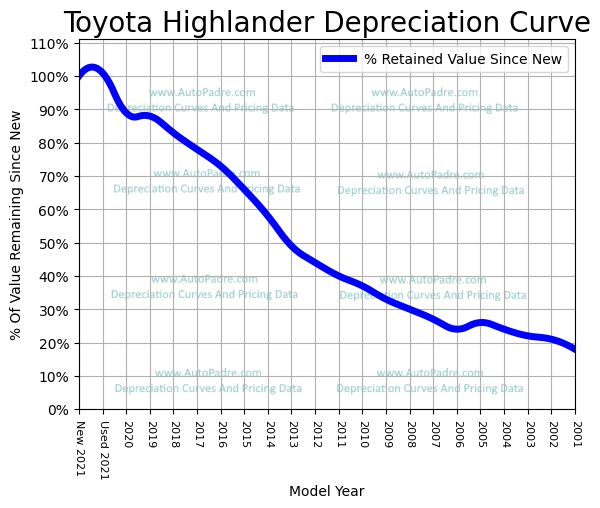

Toyota does so impressively with three models 4Runner Tacoma and Highlander ranking in the Top 10 after 5 years. These 10 Vehicles Hold Their Value Better Than Most The vehicles that hold their value best over five years are those that dont change a lot from year to year. Toyota has earned a reputation for making trouble-free vehicles and that in turn is a big driver in high resale value.

The people who want a used Tundra apparently have to have one. Ad Find Instant Quality Info Now. Understanding Depreciation Buying a pre-owned car for sale isnt the first choice for everyone but its definitely a smart move if youre cutting on costs.

Its for all of these reasons that the Toyota Tundra is the Full-Size Truck Best Resale Value Award winner for 2021. The Tundra also made iSeeCars list of top 10 vehicles with the lowest depreciation placing fourth. Overall over a 5-year period the site found a vehicle loses 496 of its value to depreciation.

Jeep Wrangler Unlimited 309 12168 2. Depreciation Depreciation is an estimate of the reduction in value incurred by owning and operating a vehicle over a period of time. IRS Section 179 depreciation deduction.